Treating yourself every once in a while is a necessity for your mental health and well-being. However, saving for your future is important too. Knowing how to strike the perfect balance between the two so that you’re able to buy the things you want without sacrificing your financial stability is critical. Do you need some help with your splurging activity? If so, here are a few tips on how to balance saving and splurging.

Table of Contents

Create a strong budget with a category for desired splurges.

Splurging can be a very spur-of-the-moment thing. However, the last thing you want to do when you’re trying to be more financially secure is to spend whenever you have a very strong urge to do so. This is why the most important thing to do when you’re trying to balance the two is to create a budget. With a strong budget, you’ll have a great overview of your monthly expenses and income, giving you a good look into how much money you actually have leftover to dedicate to your favorite things.

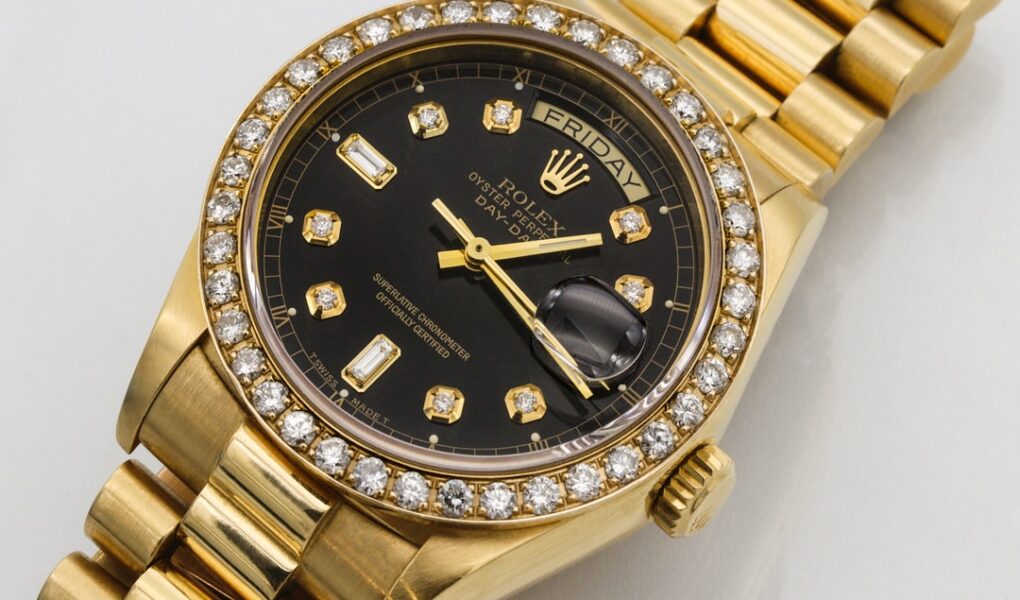

Once you have a better idea of how much money you have to allocate to miscellaneous spending, you can start creating a savings plan for items that you really want. Let’s say, for example, that you love Rolex watches. You want your own luxury timepiece, and there are plenty of Rolex watches on the market that are pre-owned to give you the best possible price. Whether you’re a fan of Rolex models like the Submariner, Explorer, or Oyster Perpetual, you’re sure to find luxury watches from Rolex that you can add to your watch collection or wear to special occasions. All you have to do is come up with a savings plan, save away a certain amount each month, and make your Rolex dreams a reality!

In that same budget, create a category for savings and investments.

The biggest problem for those who struggle to splurge and save is that they often don’t have a strict enough budget. With a good budget, you never have to worry about coming up short when you need to pay for something. This is due to the fact that you have categories for every financial action in your life, including spending. Much like you need to create a category for splurging or spending money on things you might want, you need to set financial goals for your saving and investing activity so that you’re actively contributing to your future. It’s not enough to settle on an amount and stash it away. You need to know where you’re putting your money so that you’re growing your wealth effectively. In exploring effective investment options, you might consider securities investments as an option for short term holdings you can manage as a hobby in your spare time. You may have also read all the news about cryptocurrencies in recent years, in which case you could sign up to a brokerage site such as bitcoinapex.com and dabble in some more stable cryptocurrencies for a potentially lucrative long term investment. There are other long term options you could explore too, it’s never too early to think about these things so that your retirement can be handled comfortably.

For example, if you’re planning for retirement and you want to guarantee your financial stability in the future, you might wish to invest in Multi-Year Guarantee Annuities (MYGA). Referred to also as fixed-rate annuities or certificate of deposit (CD)-type annuities, these annuity products offer a predetermined interest rate over the course of anywhere from three to 10 years. They’re similar in nature to CDs, but they often offer higher rates over the guarantee period. When you create a strong financial plan for your future, you can guarantee better results.

Look for side hustles to support your desire to splurge and save.

You can only make the money you have stretched so far, which can make both spending and splurging more difficult. If you’re feeling like your finances aren’t supporting you in the way you want, you might wish to make more space in your budget by finding a side hustle or even doing things like establishing a passive income stream. When you have more money to spend and save, you’ll find it much easier to balance both.

Splurging and saving are both important financial activities. Make balancing both easier on you using the tips above!